Great deals rarely die in the boardroom; they die in sloppy diligence. This article shows how to turn due diligence from a last-minute fire drill into a repeatable operating system that improves decision quality, accelerates timelines, and cuts surprises. I believe teams that operationalize diligence, rather than check the box, win more and regret less. What would change if your reviews were evidence-driven instead of opinion-driven? When did a hidden issue last blindside your deal team? Inside, you will get practical solutions: a structured checklist, a risk scoring rubric, simple tooling, a 30-60-90 rollout plan, and clear KPIs to prove ROI. Ready to uplevel your process? Read more, then dive into the playbook below.

Most teams treat due diligence like an obstacle course: a sprint of documents, interviews, and late-night spreadsheets before a big decision. The better way is to make diligence a repeatable operating discipline—one that improves deal quality, speeds cycle time, and reduces unpleasant surprises. For perspective on when disciplined rigor should even halt a transaction, see HBR’s “When to Walk Away from a Deal”.

What a strong due diligence checklist covers

A checklist is more than headings on a page; it scopes what to verify, assigns owners and deadlines, and defines “done.” Before you draft yours, anchor it to the decision you’re making and the risks that could change that decision.

-

Corporate & legal: cap table, governance, contracts, litigation, licenses

-

Financial: audited statements, revenue recognition, margins, cash flow, forecasts

-

Commercial & operations: customers, pipeline health, supply chain, unit economics, SLAs

-

People & HR: org design, key roles, comp/benefits, retention risks

-

Tax & compliance: filings, nexus, regulatory obligations, sanctions/export controls

-

Technology & data: architecture, cybersecurity posture, data privacy, IP ownership

-

ESG & risk: environmental exposures, safety, governance practices, reputational checks

These domains won’t be identical in every case; calibrate the depth to materiality and tailor it to the sector. In real estate, that means stress-testing title, zoning, leases, and environmental assessments—showing how a real estate due diligence checklist maps the same core principles to physical assets. For technology and data items, align evidence with NIST Cybersecurity Framework 2.0 and controls from ISO/IEC 27001 so reviewers share a common language.

Make risks visible (and actionable)

Findings only matter if they inform decisions. Establish a shared schema so teams evaluate issues the same way and convert them into concrete actions.

-

Materiality thresholds: define red/yellow/green bands for this decision

-

Evidence links: every claim points to a source in the data room

-

Mitigations & owners: each red/yellow item becomes a plan with an owner and due date

-

Decision memo: summarize must-haves vs. nice-to-haves so leaders can act

With a clear schema, your review turns from opinion-trading into evidence-driven choices—and executive approvals get faster and cleaner.

Tooling that keeps everyone aligned

Coordination problems—not analysis—cause most diligence delays. Keep the tooling simple and ruthlessly consistent so everyone knows where to look and what to update.

-

Central checklist: one live source of truth with statuses, owners, and due dates

-

Structured data room: consistent folders (01 Legal, 02 Financial, …) plus a request list

-

Issue log: lightweight tracker for questions, dependencies, and approvals

-

Audit trail: time-stamped records of what was reviewed and by whom

This backbone cuts meeting time, reduces inbox chaos, and leaves a defensible trail if questions arise post-close. If your scope includes information security or vendor IT reviews, Microsoft’s Zero Trust deployment plan for Microsoft 365 is a practical reference for mapping controls and evidence.

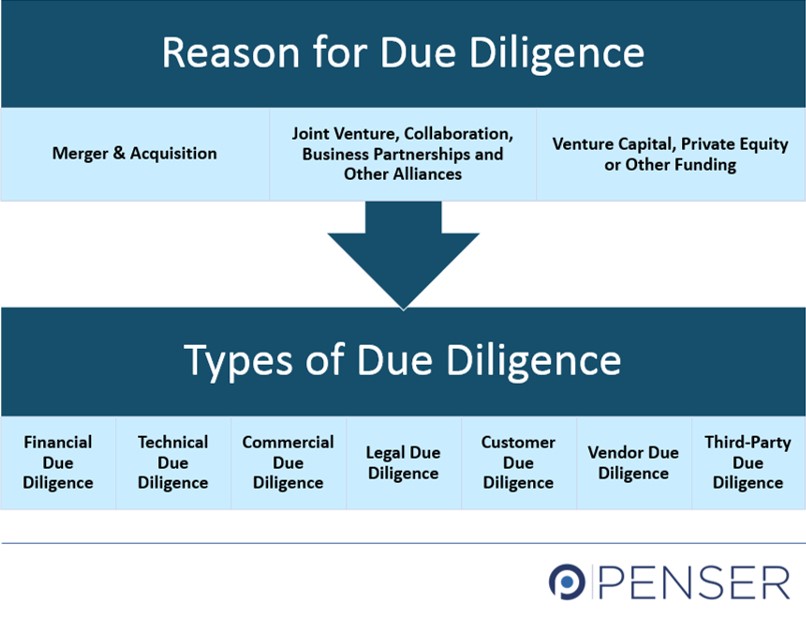

Where diligence shows its value (beyond M&A)

Diligence is a decision quality system that works across many contexts. Apply the same backbone and adjust the scope.

-

Vendor onboarding & major procurement: vet financial stability, security posture, and SLAs

-

Strategic partnerships: clarify IP boundaries, commercialization rights, and exit terms

-

Fundraising & investor readiness: pre-assemble evidentiary docs to accelerate Q&A

-

Real estate transactions: validate title, leases, zoning, and environmental compliance

Each use case benefits from structured checklists and evidence standards; only the acceptance criteria change. For a sector example you can plug in, see this real estate due diligence checklist; for cyber-heavy vendors, cross-check artifacts against NIST CSF 2.0.

A 30–60–90 day rollout you can actually follow

Don’t boil the ocean. Start small, learn fast, and standardize what works.

-

Days 1–30: Choose one live decision (deal, vendor, or partnership). Stand up a base checklist, request list, and issue log. Set materiality and RYG scoring.

-

Days 31–60: Standardize templates, data-room structure, and naming conventions. Train functional leads on evidence standards and writing mitigation plans.

-

Days 61–90: Automate status reporting, add an executive decision memo, and run a retrospective to refine thresholds and templates.

This cadence builds momentum while proving value early — without overwhelming the team. If your rollout includes security hardening, Microsoft’s concise Zero Trust Essentials eBook can help sequence investments.

How to measure ROI

If you don’t measure the process, you can’t improve it. Track a few simple metrics and review them after every major diligence.

-

Cycle time: start-to-close days per diligence type

-

Surprise rate: number of post-close adjustments or “unknown unknowns”

-

Mitigation closure: % of yellow/red issues resolved pre-signature

-

Documentation completeness: % of checklist items with linked evidence

-

Stakeholder satisfaction: quick post-process surveys

These KPIs spotlight bottlenecks and show leaders how diligence drives real outcomes, not just paperwork.

Common pitfalls to avoid

A few traps appear in nearly every review. Name them up front and put countermeasures in place.

-

Checklist theater: ticking boxes without verifying evidence → require links/screenshots and reviewer sign-off

-

Scope creep: everything becomes a priority → tie depth to materiality

-

Email chaos: findings trapped in threads → centralize decisions and docs

-

No post-mortem: repeating mistakes → run a 30-minute retro every time

Being intentional about these risks keeps the process lean, credible, and repeatable.

Conclusion

Treat due diligence as a system, not a sprint. With a clear checklist, shared materiality thresholds, simple tooling, and routine retrospectives, you can surface risks early, keep teams aligned, and make faster, more confident decisions. Start with one pilot in the next 30 days, measure cycle time and surprise rate, close mitigations before signature, and avoid the usual traps of checklist theater, scope creep, and email sprawl.